Trucks For Sale With Bad Credit: Your Ultimate Guide to Getting Back on the Road

Having bad credit can feel like a roadblock in many areas of life, and buying a reliable truck is often one of them. The good news? It's absolutely possible to find trucks for sale even with a less-than-perfect credit score. This comprehensive guide will walk you through everything you need to know, from understanding your credit situation to securing financing and finding the right truck for your needs.

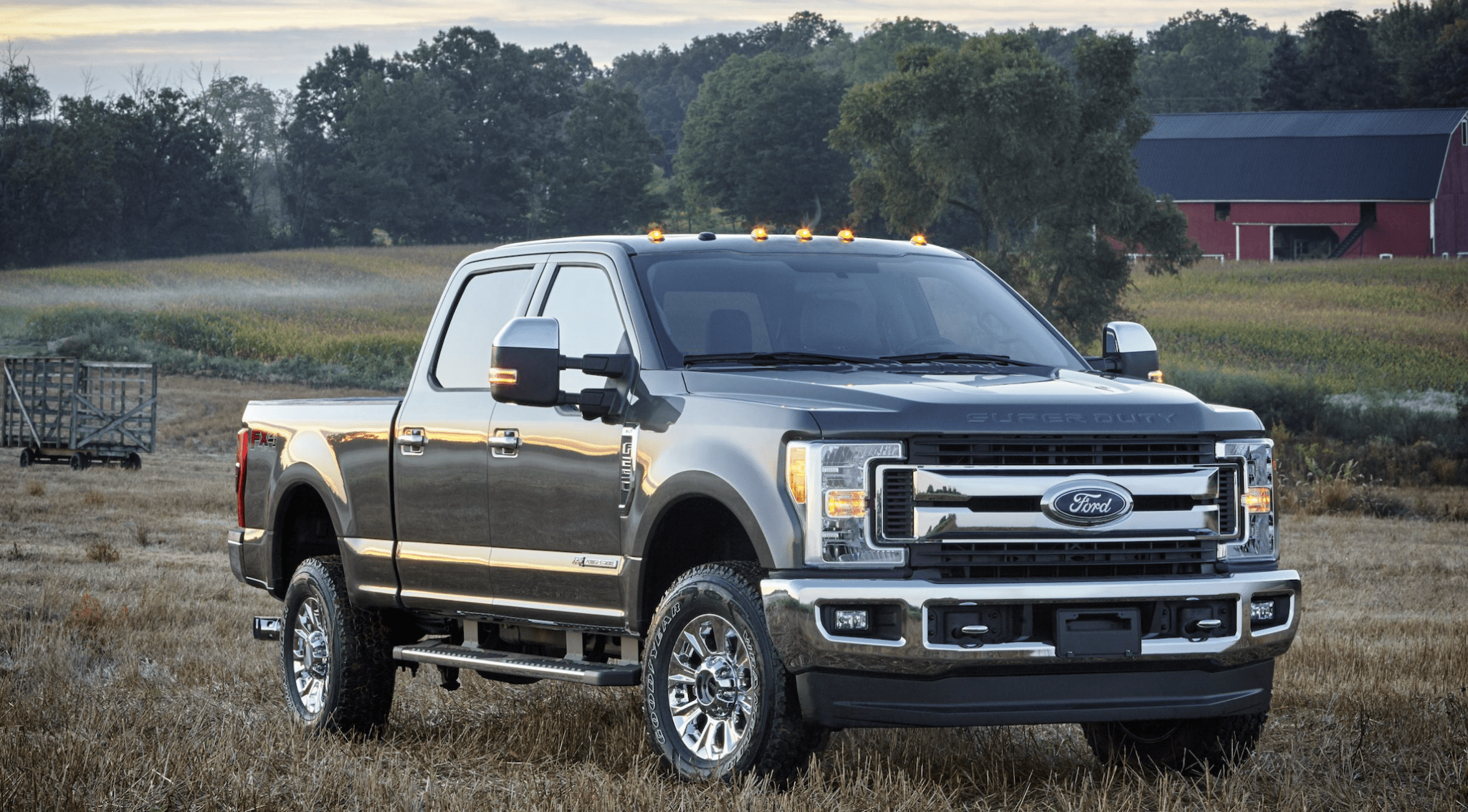

Trucks For Sale With Bad Credit

We'll cover actionable strategies, potential pitfalls, and insider tips to navigate the process successfully. My goal is to equip you with the knowledge and confidence to drive away in a truck you can afford, without getting buried in debt.

Understanding Your Credit and Its Impact

Before you even start browsing truck dealerships, it's crucial to understand where you stand credit-wise. Your credit score is a three-digit number that lenders use to assess your creditworthiness. It reflects your history of borrowing and repaying debt.

A lower credit score signals higher risk to lenders, resulting in higher interest rates or loan denials.

- Check Your Credit Report: Obtain a free copy of your credit report from AnnualCreditReport.com. Review it carefully for any errors or inaccuracies. Disputes these errors immediately, as they can negatively impact your score.

- Understand Credit Score Ranges: Familiarize yourself with the different credit score ranges (e.g., Excellent, Good, Fair, Poor). Knowing your range gives you a realistic understanding of your financing options.

- Identify Negative Factors: Look for negative items on your report, such as late payments, collections, or bankruptcies. Addressing these issues can help improve your credit over time.

Why Trucks Are Often Financed (and Why Bad Credit Makes It Harder)

Trucks, especially newer models, often come with a significant price tag. Most people don't have the cash on hand to buy one outright, so they rely on financing. This means taking out a loan and making monthly payments until the truck is paid off.

Bad credit makes securing a truck loan more challenging due to a few key reasons:

- Higher Interest Rates: Lenders see bad credit as a higher risk, so they compensate by charging higher interest rates. This means you'll pay more over the life of the loan.

- Stricter Loan Terms: You might face shorter loan terms, requiring larger monthly payments. Lenders might also ask for a larger down payment to offset the risk.

- Loan Denials: In some cases, lenders may simply deny your loan application if your credit score is too low.

Strategies to Improve Your Chances of Getting Approved

Even with bad credit, there are several steps you can take to increase your chances of getting approved for a truck loan:

-

Improve Your Credit Score (If Possible):

- Pay Bills on Time: This is the most crucial factor. Set up automatic payments to avoid missing deadlines.

- Reduce Credit Card Debt: Aim to pay down your credit card balances, especially those with high interest rates.

- Become an Authorized User: Ask a trusted friend or family member with good credit to add you as an authorized user on their credit card. This can help boost your score.

-

Save for a Larger Down Payment:

- A larger down payment reduces the loan amount you need, making you a less risky borrower.

- It also shows lenders that you are serious about the purchase and have some financial stability.

-

Find a Cosigner:

- A cosigner is someone with good credit who agrees to be responsible for the loan if you default.

- This reduces the lender's risk and can significantly improve your chances of approval.

-

Shop Around for Lenders:

- Don't settle for the first loan offer you receive. Compare rates and terms from multiple lenders.

- Consider credit unions, online lenders, and dealerships that specialize in bad credit financing.

-

Consider a Used Truck:

- Used trucks are generally more affordable than new trucks, making them easier to finance.

- Focus on finding a reliable used truck that fits your needs and budget.

Where to Find Trucks for Sale With Bad Credit

Several options are available when searching for trucks for sale if you have bad credit:

- Buy Here Pay Here Dealerships: These dealerships offer in-house financing, often without a credit check. While convenient, interest rates tend to be very high, and the truck selection might be limited. Proceed with caution and carefully review the terms.

- Special Finance Dealerships: These dealerships specialize in working with customers who have bad credit. They have relationships with lenders who are willing to take on more risk.

- Credit Unions: Credit unions often offer more favorable loan terms than traditional banks, especially to their members. Explore options with local credit unions.

- Online Lenders: Several online lenders cater to borrowers with bad credit. Compare rates and terms carefully before applying.

- Private Sellers: Buying from a private seller can sometimes be a good option, especially if you can negotiate a good price. However, you'll need to secure financing on your own.

Negotiating and Securing Financing

Once you've found a truck you like, the next step is negotiating the price and securing financing. Here are some tips:

- Get Pre-Approved for a Loan: This gives you a clear idea of how much you can afford and strengthens your negotiating position.

- Research the Truck's Value: Use resources like Kelley Blue Book or Edmunds to determine the fair market value of the truck.

- Negotiate the Price: Don't be afraid to negotiate the price down. Point out any flaws or issues with the truck.

- Read the Fine Print: Carefully review all loan documents before signing. Pay attention to the interest rate, loan term, monthly payment, and any fees.

- Don't Be Pressured: Don't feel pressured to make a decision on the spot. Take your time to consider all your options.

Common Mistakes to Avoid

Based on my experience, many people with bad credit make the same mistakes when buying a truck. Here are some common pitfalls to avoid:

- Focusing Solely on the Monthly Payment: Don't just focus on the monthly payment. Pay attention to the total cost of the loan, including interest and fees.

- Skipping the Inspection: Always have a mechanic inspect the truck before you buy it, especially if it's a used truck. This can help you avoid costly repairs down the road.

- Overextending Yourself: Don't buy a truck that you can't realistically afford. Consider your other expenses and ensure you can comfortably make the monthly payments.

- Ignoring the Interest Rate: The interest rate can significantly impact the total cost of the loan. Shop around for the best rate possible.

- Failing to Read the Fine Print: Always read the fine print of the loan agreement before signing. Understand all the terms and conditions.

Pro tips from us: Before committing to a purchase, take the truck for a thorough test drive. Pay attention to the engine, transmission, brakes, and steering. Also, check for any signs of rust or damage.

Maintaining Your Truck and Improving Your Credit

Once you've bought your truck, it's essential to maintain it properly and continue working on improving your credit.

- Regular Maintenance: Follow the manufacturer's recommended maintenance schedule. This will help keep your truck running smoothly and prevent costly repairs.

- Make Timely Payments: Continue making timely payments on all your debts, including your truck loan. This will help improve your credit score over time.

- Monitor Your Credit Report: Regularly monitor your credit report for any errors or inaccuracies. Dispute any errors immediately.

- Use Credit Wisely: Use credit responsibly to build a positive credit history. This will make it easier to get approved for loans in the future.

The Bottom Line

Buying a truck with bad credit can be challenging, but it's definitely possible. By understanding your credit situation, taking steps to improve your chances of approval, and shopping around for the best financing options, you can drive away in a truck you can afford.

Remember to be patient, do your research, and avoid common mistakes. With the right approach, you can get back on the road and start rebuilding your credit. Don't let past credit challenges hold you back from achieving your goals.

External Link: For more information on credit scores, visit Experian's website.

Internal Link (Example): Check out our other article on [Tips for Saving Money on Car Insurance](Your Internal Link Here).

This guide provides a comprehensive overview of buying trucks for sale with bad credit. It addresses key aspects from understanding credit to securing financing and maintaining your vehicle. By following these tips and avoiding common mistakes, you can navigate the process successfully and get back on the road.