Trucks For Sale Bad Credit: Your Comprehensive Guide to Getting Back on the Road

Having bad credit can feel like a roadblock to achieving your goals, especially when you need a reliable truck for work, family, or just everyday life. The good news is that securing trucks for sale bad credit is absolutely possible. This guide will walk you through the entire process, from understanding your credit situation to finding the right financing options and choosing the perfect truck, even with a less-than-perfect credit score. We'll explore the ins and outs of navigating the market, avoiding common pitfalls, and ultimately driving away in the truck you need.

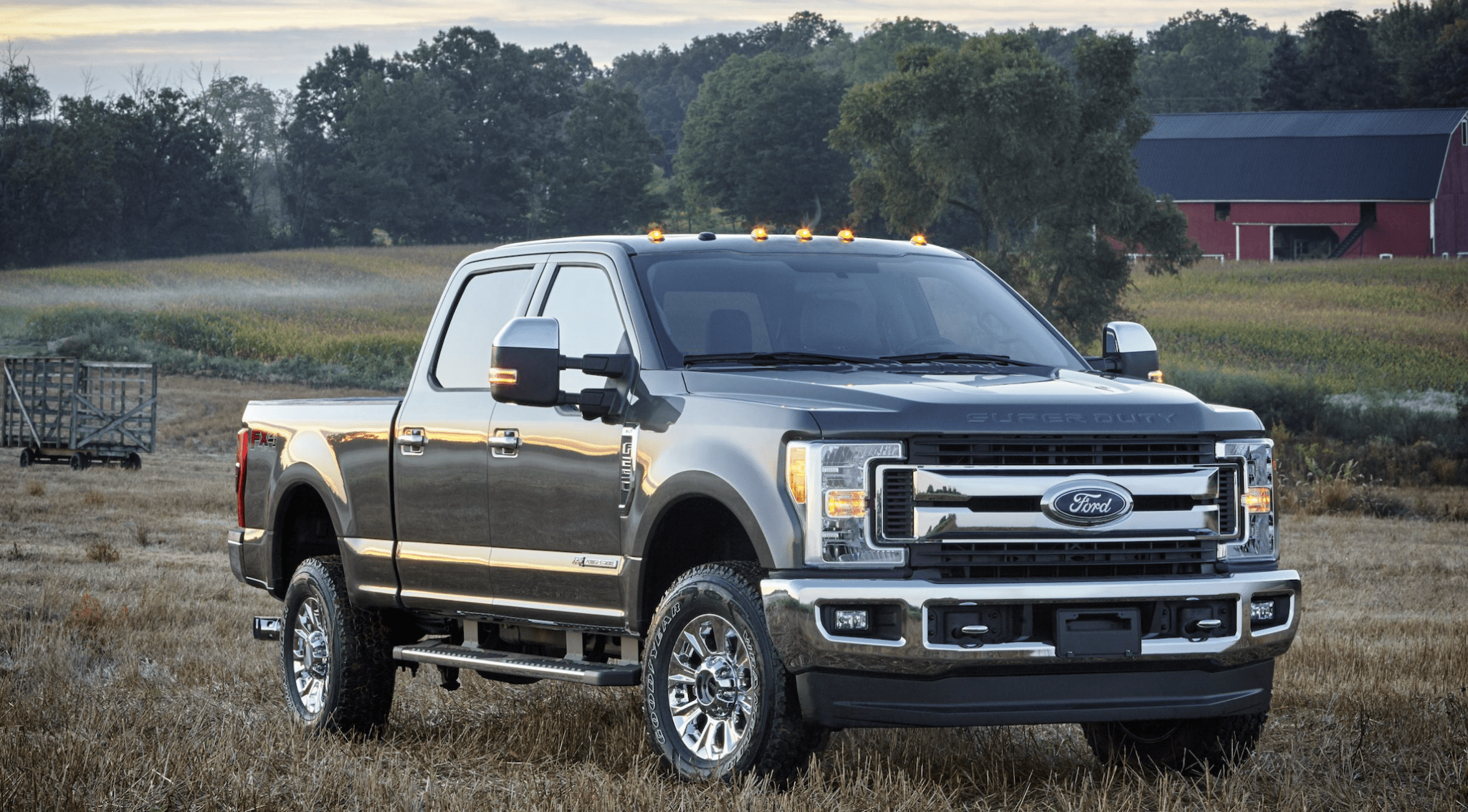

Trucks For Sale Bad Credit

Understanding Your Credit and Its Impact on Truck Loans

Before you start browsing dealerships, it's crucial to understand where you stand. Your credit score is a numerical representation of your creditworthiness, based on your payment history, outstanding debt, length of credit history, credit mix, and new credit applications.

-

Know Your Credit Score: Obtain a copy of your credit report from all three major credit bureaus (Experian, Equifax, and TransUnion). This will give you a clear picture of your credit history and identify any errors that might be dragging down your score. Several websites offer free credit reports annually.

-

Understand the Impact: A lower credit score typically translates to higher interest rates on your truck loan. It might also limit your choices regarding loan terms and the types of trucks you can finance.

-

Improve Your Score (If Possible): Even a small improvement in your credit score can make a big difference. Pay down existing debt, avoid late payments, and keep your credit utilization low (the amount of credit you're using compared to your total available credit).

Financing Options for Trucks for Sale Bad Credit

Traditional banks and credit unions can be hesitant to approve loans for individuals with bad credit. Fortunately, several alternative financing options are available:

-

Buy Here Pay Here Dealerships: These dealerships specialize in providing financing to customers with poor credit. They often don't rely heavily on credit scores, but their interest rates tend to be significantly higher.

- Pros: Easier approval, convenient on-site financing.

- Cons: Higher interest rates, limited truck selection, potential for predatory lending practices.

Based on my experience, Buy Here Pay Here dealerships can be a lifeline, but it's essential to be extra cautious and read the fine print carefully. Always compare the total cost of the loan, including interest and fees, before making a decision.

-

Credit Unions: While traditional banks may be strict, some credit unions are more willing to work with individuals with bad credit, especially if you're already a member.

- Pros: Potentially lower interest rates than Buy Here Pay Here dealerships, more personalized service.

- Cons: Membership requirements, may still have stricter approval criteria than Buy Here Pay Here options.

-

Online Lenders: Numerous online lenders specialize in auto loans for people with bad credit. They often offer a wider range of options and more competitive rates than traditional lenders.

- Pros: Convenient application process, comparison shopping, potentially better rates than Buy Here Pay Here.

- Cons: Potential for hidden fees, less personalized service, need to be cautious of scams.

-

Co-Signer: Having a friend or family member with good credit co-sign your loan can significantly increase your chances of approval and secure a lower interest rate.

- Pros: Increased approval odds, lower interest rates.

- Cons: Puts the co-signer at risk if you default on the loan.

-

Down Payment: A larger down payment demonstrates your commitment to the loan and reduces the lender's risk, increasing your chances of approval and potentially lowering your interest rate.

Finding the Right Truck: Balancing Needs and Budget

When shopping for trucks for sale bad credit, it's important to be realistic about your budget and needs. Don't get caught up in features you don't need, as they'll only increase the price and your monthly payments.

-

Determine Your Needs: What will you primarily use the truck for? Work, family, recreation? Knowing your needs will help you narrow down your search to specific truck types and features.

-

Set a Realistic Budget: Calculate how much you can realistically afford each month, considering your income, expenses, and other financial obligations. Factor in not only the loan payment but also insurance, fuel, maintenance, and potential repairs.

-

Consider Used Trucks: Buying a used truck can save you a significant amount of money compared to buying new. A well-maintained used truck can provide years of reliable service at a fraction of the cost.

-

Research Truck Models: Before you start shopping, research different truck models to identify those known for their reliability, fuel efficiency, and affordability.

-

Get a Pre-Purchase Inspection: Before you commit to buying any used truck, have it inspected by a trusted mechanic. This will help you identify any potential problems and avoid costly repairs down the road.

Negotiating the Best Deal on Trucks for Sale Bad Credit

Negotiation is key to getting the best possible deal on trucks for sale bad credit. Don't be afraid to haggle and walk away if you're not comfortable with the terms.

-

Do Your Research: Know the market value of the truck you're interested in. Use online resources like Kelley Blue Book and Edmunds to get an estimate of the truck's worth.

-

Shop Around: Get quotes from multiple dealerships and lenders to compare prices and financing options.

-

Focus on the Out-the-Door Price: Don't just focus on the monthly payment. Pay attention to the total cost of the loan, including interest, fees, and taxes.

-

Be Prepared to Walk Away: If the dealer isn't willing to meet your terms, be prepared to walk away. There are plenty of other trucks for sale.

Common Mistakes to Avoid When Buying Trucks for Sale Bad Credit

-

Not Checking Your Credit Report: Failing to review your credit report before applying for a loan can lead to unpleasant surprises and missed opportunities to correct errors.

-

Accepting the First Offer: Don't settle for the first loan offer you receive. Shop around and compare rates from multiple lenders.

-

Overextending Yourself: Buying a truck that's too expensive can lead to financial stress and potential default. Stick to a budget you can comfortably afford.

-

Ignoring the Fine Print: Always read the loan agreement carefully before signing. Pay attention to the interest rate, fees, and repayment terms.

-

Skipping the Inspection: Failing to have a used truck inspected by a mechanic can lead to costly repairs down the road.

-

Falling for Add-ons: Dealerships often try to sell add-ons like extended warranties and paint protection. Consider whether these add-ons are truly necessary and worth the cost.

Building Credit While Owning Your Truck

Once you've secured your truck, it's essential to use it as an opportunity to rebuild your credit.

-

Make Timely Payments: The most important thing you can do is make your loan payments on time, every time.

-

Avoid Late Fees: Late payments can damage your credit score and add to the cost of your loan.

-

Consider a Secured Credit Card: A secured credit card can help you rebuild your credit by reporting your payment activity to the credit bureaus.

-

Keep Credit Utilization Low: Keep your credit card balances low compared to your credit limits.

Pro tips from us: Consider setting up automatic payments to ensure you never miss a due date. This simple step can significantly improve your creditworthiness over time.

Maintaining Your Truck and Protecting Your Investment

Owning a truck is a responsibility. Proper maintenance is crucial to keeping your truck running smoothly and protecting your investment.

-

Follow the Maintenance Schedule: Adhere to the manufacturer's recommended maintenance schedule for oil changes, fluid flushes, and other services.

-

Address Repairs Promptly: Don't delay necessary repairs. Small problems can quickly escalate into major issues if left unattended.

-

Keep Your Truck Clean: Regular washing and waxing can protect your truck's paint and prevent rust.

-

Drive Responsibly: Avoid aggressive driving, which can put unnecessary wear and tear on your truck.

Alternative Transportation Options to Consider

While owning a truck is desirable, it's worth considering alternative transportation options, especially if you're struggling with bad credit.

-

Public Transportation: If available in your area, public transportation can be a cost-effective way to get around.

-

Ride-Sharing Services: Ride-sharing services like Uber and Lyft can be convenient for occasional trips.

-

Bicycle or Scooter: For short commutes, a bicycle or scooter can be a healthy and eco-friendly option.

Resources for Finding Trucks for Sale Bad Credit

-

Online Auto Marketplaces: Websites like AutoTrader, Cars.com, and CarGurus list thousands of trucks for sale across the country. [External Link to Kelley Blue Book]

-

Dealership Websites: Most dealerships have websites where you can browse their inventory and apply for financing.

-

Local Classifieds: Check local classified ads in newspapers and online for trucks for sale by private owners.

-

Credit Counseling Agencies: Non-profit credit counseling agencies can provide guidance on managing your debt and improving your credit score.

Conclusion: Getting Back on the Road with Trucks for Sale Bad Credit

Securing trucks for sale bad credit requires careful planning, research, and a realistic approach. By understanding your credit situation, exploring your financing options, and choosing the right truck for your needs and budget, you can overcome the challenges of bad credit and get back on the road. Remember to focus on rebuilding your credit, maintaining your truck, and protecting your investment. With persistence and a smart strategy, you can achieve your transportation goals, even with a less-than-perfect credit history. Don't let bad credit hold you back from the freedom and utility a truck can provide. Take control of your situation, explore the options available to you, and drive away with confidence! [Internal Link to another relevant article on budgeting or credit repair on your blog, if available] [Internal Link to another relevant article on different truck models or types on your blog, if available]