Lease Purchase Semi Truck With Bad Credit: Your Comprehensive Guide to Getting on the Road

The open road calls to many, but for those with less-than-perfect credit, the dream of owning and operating a semi-truck can seem distant. Traditional financing options often slam the door shut, leaving aspiring owner-operators feeling stuck. However, there's a viable alternative: lease purchase programs. These programs offer a pathway to truck ownership, even with bad credit, but it's crucial to understand the intricacies involved. This comprehensive guide will break down everything you need to know about lease purchase semi-truck programs, helping you make an informed decision and potentially kickstart your career as an independent trucker.

Lease Purchase Semi Truck With Bad Credit

Understanding Lease Purchase Programs

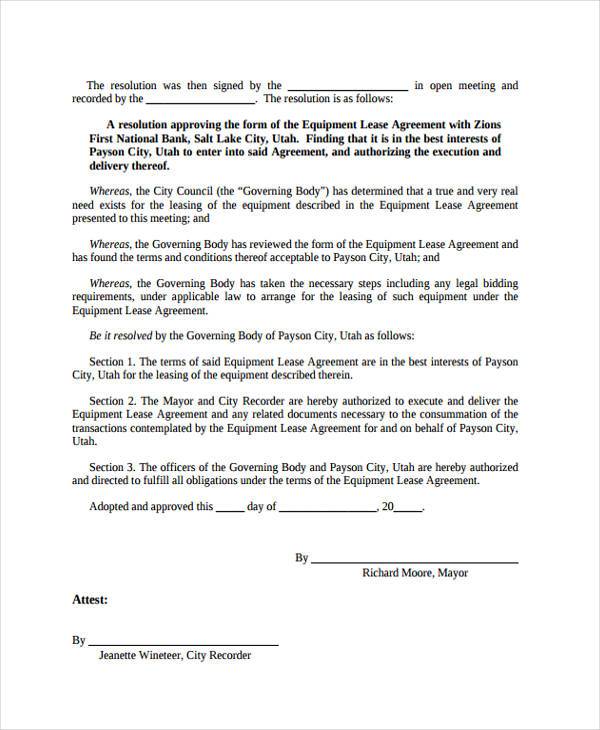

A lease purchase agreement is essentially a hybrid between leasing and buying a semi-truck. You lease the truck for a specific period, typically 2-5 years, and a portion of your lease payments goes towards the eventual purchase of the vehicle. At the end of the lease term, you have the option to purchase the truck outright for a predetermined price.

Think of it as a "rent-to-own" arrangement for a semi-truck. This structure makes it more accessible for individuals with credit challenges because the lender (usually a trucking company or a financing company specializing in transportation) is more focused on your driving experience and earning potential than your credit score alone.

Why Lease Purchase Can Be a Good Option With Bad Credit

-

Lower Credit Requirements: This is the primary advantage. Lease purchase programs generally have less stringent credit requirements compared to traditional truck loans. This opens doors for drivers who have faced financial difficulties in the past but are now ready to commit to a trucking career.

-

Opportunity to Build Equity: Unlike straight leasing, a portion of your payments goes towards ownership. Over time, you build equity in the truck, increasing your assets and moving closer to full ownership. This can be a significant financial benefit.

-

Potential for Higher Earnings: As an owner-operator (or on the path to becoming one), you have the potential to earn more than a company driver. You have more control over the loads you haul and the routes you take, allowing you to maximize your income.

-

Pathway to Truck Ownership: For many, the ultimate goal is to own their own truck. Lease purchase programs provide a structured and relatively accessible way to achieve this goal, even with credit imperfections.

The Downsides and Risks of Lease Purchase Programs

While lease purchase programs offer opportunities, it's essential to be aware of the potential downsides and risks:

-

Higher Overall Cost: Lease purchase programs often have higher interest rates and overall costs compared to traditional financing. This is because the lender is taking on more risk by working with individuals with bad credit. Expect to pay more for the truck in the long run.

-

Maintenance Responsibilities: As the lease purchaser, you are typically responsible for all maintenance and repairs on the truck. This can be a significant expense, especially for older vehicles. Always factor in maintenance costs when evaluating a lease purchase agreement.

-

Limited Flexibility: Lease purchase agreements are typically long-term commitments. Breaking the agreement can result in penalties and the loss of any equity you've built in the truck.

-

Potential for Exploitation: Unfortunately, some less reputable companies may take advantage of drivers with bad credit. They might offer unfavorable terms, inflated prices, or hidden fees. It's crucial to thoroughly research any company before entering into a lease purchase agreement.

-

Mileage Restrictions: Some programs may impose mileage restrictions. Exceeding these limits can result in extra charges.

-

Forced Dispatch: Some programs may require you to run loads exclusively for the company offering the lease purchase. This limits your ability to shop for better-paying loads and can affect your overall profitability.

Key Factors to Consider Before Entering a Lease Purchase Agreement

Before signing on the dotted line, carefully consider these factors:

-

The Total Cost of the Truck: Don't just focus on the monthly payment. Calculate the total cost of the truck over the entire lease term, including interest, fees, and the final purchase price. Compare this to the market value of the truck to ensure you're not overpaying.

-

Maintenance Responsibilities and Costs: Understand who is responsible for maintenance and repairs. Get an estimate of potential maintenance costs for the specific truck you're considering. A pre-purchase inspection by a qualified mechanic is highly recommended.

-

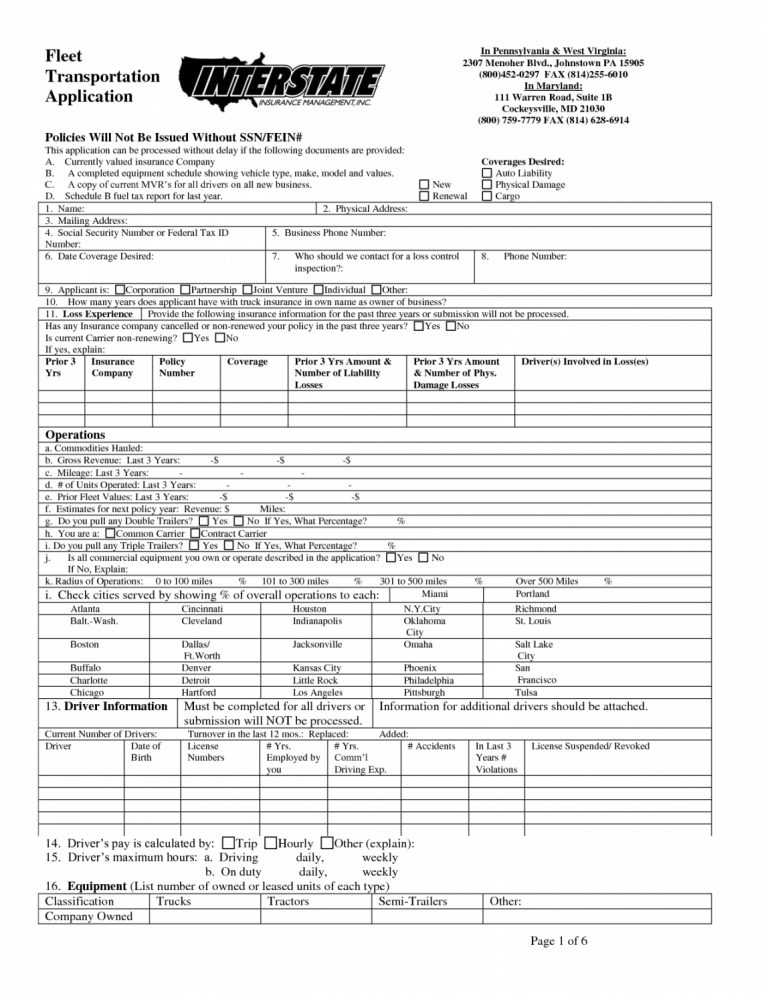

Insurance Requirements: Determine the insurance requirements of the lease purchase program. Insurance costs can vary significantly, so factor this into your overall budget.

-

Mileage Restrictions: Check for any mileage restrictions and the associated penalties for exceeding them.

-

Termination Clause: Understand the terms of the termination clause. What happens if you can't make payments or need to break the agreement?

-

Company Reputation: Research the company offering the lease purchase program. Check online reviews, talk to other drivers who have worked with them, and look for any red flags.

-

Escrow Accounts: Be wary of large escrow accounts that you have to pay into. Understand where that money is going, and how and when you'll receive it back.

Tips for Finding a Reputable Lease Purchase Program

-

Do Your Research: Thoroughly research different companies and programs. Read online reviews, check with the Better Business Bureau, and talk to other drivers.

-

Get Everything in Writing: Ensure all terms and conditions are clearly outlined in a written agreement. Don't rely on verbal promises.

-

Seek Professional Advice: Consult with an attorney or financial advisor before signing any lease purchase agreement. They can help you understand the terms and identify any potential risks.

-

Compare Multiple Offers: Don't settle for the first offer you receive. Shop around and compare different lease purchase programs to find the best terms and conditions.

-

Look for Transparency: A reputable company will be transparent about all costs, fees, and requirements. Be wary of companies that are vague or evasive.

-

Ask Questions: Don't hesitate to ask questions. A reputable company will be happy to answer your questions and address any concerns you may have.

Improving Your Credit Score for Better Financing Options

While lease purchase programs can be a viable option with bad credit, improving your credit score can open up more financing options in the future. Here are some tips for improving your credit:

-

Pay Bills on Time: This is the most important factor in your credit score. Make sure to pay all your bills on time, every time.

-

Reduce Debt: Pay down your existing debt, especially high-interest debt like credit card balances.

-

Check Your Credit Report: Obtain a copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) and check for any errors or inaccuracies. Dispute any errors you find.

-

Become an Authorized User: Ask a friend or family member with good credit to add you as an authorized user on their credit card. This can help you build credit history.

-

Secured Credit Card: Consider getting a secured credit card. This is a credit card that requires a security deposit, which acts as your credit limit. Use the card responsibly and pay your bills on time to build credit.

Alternatives to Lease Purchase Programs

If you're not comfortable with a lease purchase program, here are some alternative options:

-

Company Driver: Work as a company driver for a trucking company. This provides a steady income and benefits without the financial risks of ownership. This allows you to save money and improve your credit score before pursuing ownership.

-

Team Driving: Partner with another driver and share the costs and responsibilities of truck ownership.

-

Owner-Operator with Traditional Financing (Eventually): Focus on improving your credit score and saving money so you can eventually qualify for traditional truck financing.

Common Mistakes to Avoid

Based on my experience working with drivers, here are some common mistakes to avoid when considering a lease purchase program:

-

Not Reading the Fine Print: Always read the entire lease purchase agreement carefully before signing. Don't rely on verbal promises.

-

Overestimating Income: Be realistic about your earning potential. Don't assume you'll be able to make enough money to cover your payments and expenses.

-

Ignoring Maintenance Costs: Maintenance costs can be significant. Factor these costs into your budget.

-

Failing to Shop Around: Compare multiple offers before making a decision.

-

Not Seeking Professional Advice: Consult with an attorney or financial advisor before signing any agreement.

The Future of Lease Purchase Programs

Lease purchase programs will likely continue to be a viable option for drivers with bad credit. As the demand for truck drivers continues to grow, these programs can provide a pathway to truck ownership for those who might otherwise be excluded. However, it's crucial to approach these programs with caution and do your due diligence to avoid potential pitfalls.

Conclusion: Making the Right Choice for You

Lease purchase semi-truck programs can be a valuable tool for aspiring owner-operators with bad credit, offering a pathway to truck ownership and increased earning potential. However, they are not without risks. It's crucial to thoroughly research your options, understand the terms and conditions of the agreement, and seek professional advice before making a decision. By carefully considering the factors outlined in this guide, you can make an informed choice and determine if a lease purchase program is the right fit for your individual circumstances and goals. Remember to prioritize your financial well-being and make sure you are comfortable with the commitment before signing any agreement. The road to truck ownership may be challenging, but with the right knowledge and preparation, it's an achievable goal.

External Link: For additional information on trucking industry trends and regulations, consider visiting the website of the Federal Motor Carrier Safety Administration (FMCSA).

This article aims to provide a comprehensive overview of lease purchase programs for semi-trucks, specifically addressing the needs and concerns of individuals with bad credit. By understanding the pros and cons, key factors, and potential pitfalls, aspiring owner-operators can make informed decisions and embark on a successful career in the trucking industry.